TC Energy spinning off Keystone Pipeline, 18 years after it was first proposed

By Brian Zinchuk

CALGARY – TC Energy is spinning off its liquids pipelines, principally its Keystone/Marketlink system, into a separate, yet to be named company. The move comes 18 years after the natural gas pipeline giant decided to get into oil pipelines, and this spinoff marks its exist from that market.

The spinoff, announced July 27, also comes after more than a decade of battles to get two major oil pipelines built – Keystone XL and Energy East. Both of those projects failed disastrously, especially when it came to more than a billion dollars of charges for each project. For KXL, it was a $2.2 billion writedown, and for Energy East, a billion.

The announcement was made after markets closed on Thursday. In addition to the Keystone Pipeline system, it will also include the Grand Rapids Pipeline and White Spruce Pipeline, both in northern Alberta, and carry crude oil and diluent.

TC Energy characterized the spinoff as unlocking value “by creating two premium energy infrastructure companies.”

Trucks loaded with joints of pipe intended to become the Keystone XL rumbled through Shaunavon in July, 2011. Photo by Brian Zinchuk

The two companies would be independent of each other. However, since the Canadian portion of the Keystone Pipeline is almost entirely completely integrated within the right of way and compressor pumping stations of the TC Energy mainline, how this will be accomplished operationally has not be revealed.

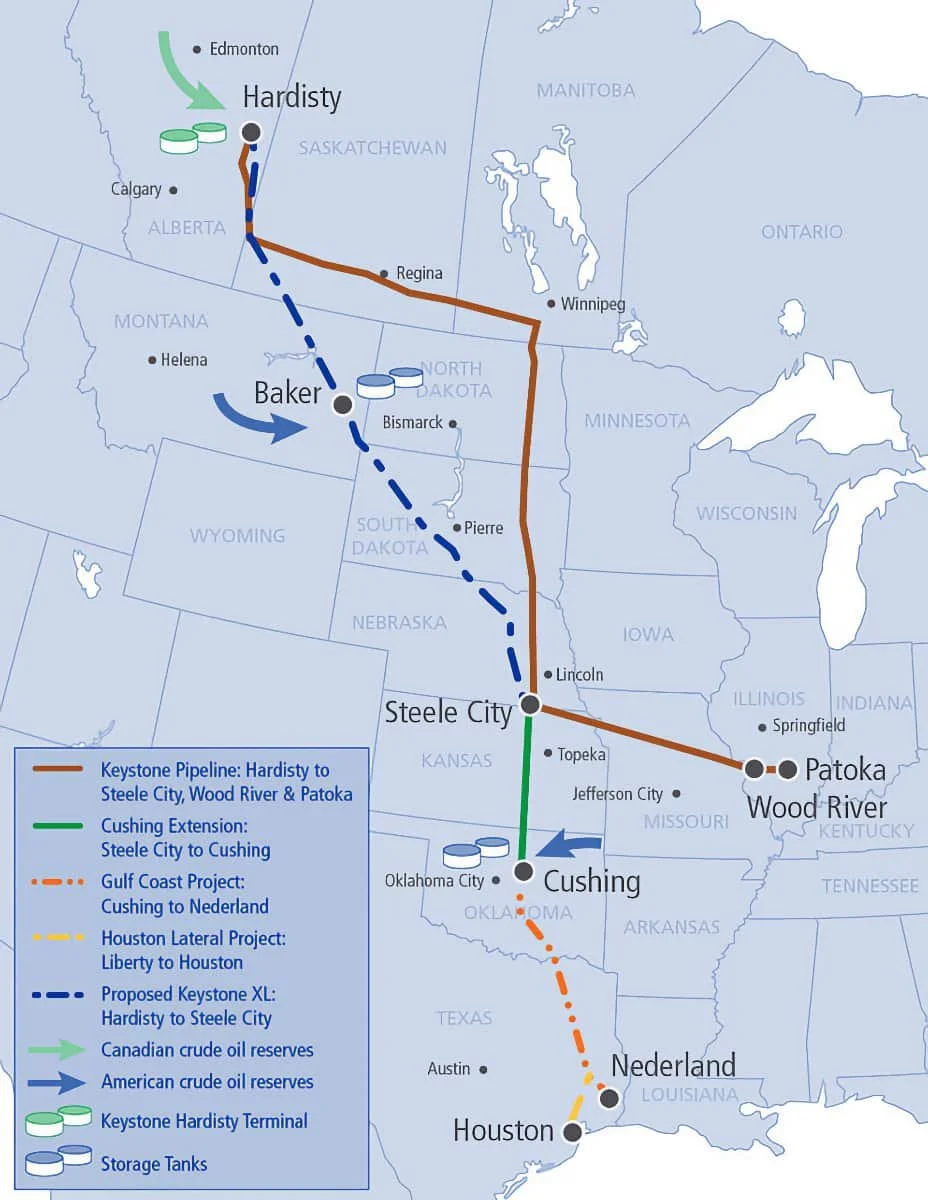

In Canada, nearly all of the Keystone Pipeline was converted from a pre-existing gas pipeline within the mainline. The Keystone Pipeline runs from the principal oil terminal in Western Canada, at Hardisty Alberta, almost straight south to where the gas mainline kicks off, at the Alberta/Saskatchewan border. It goes almost straight east, from Burstall to Moosomin. It continues east until it breaks away from the mainline west of Winnipeg. The remainder of Keystone goes almost straight south, with major points at Steele City, Nebraska, Cushing, Oklahoma, and Port Arthur, Texas, on the Gulf Coast. There it ties into the Gulf Coast refining complex. A lateral from Nebraska runs to central Illinois.

As of March 3, the Canadian Energy Regulator reported it was exporting 588,000 barrels of oil per day from Canada to the U.S., nearly every drop of that being heavy oil, and at a 100 per cent utilization rate. It first went into operation in 2010.

TC Energy said in a release, “The spinoff will unlock shareholder value by providing both companies with the flexibility to pursue their own growth objectives through disciplined capital allocation, enhancing efficiencies and driving operational excellence. Once completed, the spinoff will result in two high-quality, focused energy industry leaders that are committed to providing safe and reliable service to their customers and the communities in which they operate.”

“This transformative announcement sets us up to deliver superior shareholder value for the next decade and beyond. Fundamentals have always driven our strategic direction, and as a result, we have grown into a premier energy company with incumbency across a wide range of energy infrastructure platforms. As we have become the partner of choice for a magnitude of accretive, high-quality opportunities, we have determined that as two separate companies we can better execute on these distinct opportunity sets to unlock shareholder value,” said François Poirier, TC Energy’s president and chief executive officer.

“Following the transaction, TC Energy will focus on natural gas infrastructure, supported by strong, long-term fundamentals and power and energy solutions, driven by nuclear, pumped hydro energy storage and new energy opportunities while continuing its history of maximizing asset value and operational performance,” the release said.

It continued, “The new Liquids Pipelines Company will focus on enhancing the value of its unrivalled asset base by increasing capacity on underutilized portions of the system and increasing connectivity to additional receipt and delivery points. As a low-risk business with 96 per cent investment-grade customers and 88 per cent of comparable EBITDA3 contracted, the Liquids Pipelines Company retains the TC Energy premium value proposition, and expands upon it with the flexibility to focus on its competitive advantages.”

Leadership

François Poirier will remain as president and CEO of TC Energy. The new Liquids Pipelines Company will be led by Bevin Wirzba as President and CEO, and will be supported by a proven leadership team with deep capabilities and skillsets directly related to the portfolio. The company will be headquartered in Calgary, Alberta, with an office in Houston, Texas.

“This team has created one of the most competitive Liquids systems in North America, with the most direct, cost-effective and highest quality paths to key demand markets. It is a highly contracted business with stable, robust cash flows supported by long-term customers. Following the spinoff, they will have increased financial flexibility to leverage their well-established expertise and competitive footprint to originate accretive, disciplined growth opportunities. As its own entity, the Liquids Pipelines Company’s comparable EBITDA3 is expected to grow at a two to three per cent compound annual growth rate through 2026 with a commensurate dividend growth outlook, delivering sustainable shareholder value,” added Poirier.

TC Energy said it intends that the initial combined dividends of the two companies will be equivalent to TC Energy’s annual dividend immediately prior to the completion of the Transaction, and that over time the combined value of the two companies’ dividends is expected to remain consistent. Dividends will be at the discretion of the respective boards of directors of each company following the transaction.

Under the proposed Transaction, TC Energy shareholders will retain their current ownership in TC Energy’s common shares (TRP: TSX, TRP: NYSE) and receive a pro-rata allocation of common shares in the new Liquids Pipelines Company. The Transaction is expected to be tax-free for TC Energy’s Canadian and U.S. shareholders. The determination of the number of common shares in the new Liquids Pipelines Company to be distributed to TC Energy shareholders will be determined prior to the closing of the proposed transaction.

That closing is expected in the second half of 2024, after regulatory approval in Canada and the United States, as well as a shareholders meeting in mid-2024.