The Klarenbach Report, Aug 22

My small town of Eatonia had a second-hand consignment store.

I want to say it opened in the early 1980s.

It could have been in the late 1970s.

I was a young boy then; time was abundant, and dates seemed unimportant. Unlike now, when time is becoming scarce.

The second-hand store was full of treasures for a boy like me.

I was not interested in the various toys, household appliances and children’s clothing.

Nope, I was introduced to the magic of reading at a young age and was seduced by the packages of rolled-up comic books and magazines offered for purchase.

10 for a $1 is what I remember. What a deal!

Inside one of those rolls was Alfred E. Newman and his gap toothed grin on the cover of a MAD Magazine with the heading “What Me Worry?”.

It has been suggested that I would have been better off reading one of the literary classics available; however, Mad magazine introduced me to the buzzword of the 1970s.

Inflation.

Forty years later, I still have not read any classic novels (although I watch the Alice in Wonderland movies multiple times a year. Does that count?), and inflation is still in the news and almost every conversation.

Inflation is affecting everyone on all four corners of the planet. While some are benefiting from inflation, it is catastrophic for others.

Inflation is a product of a complex worldwide economic system where simplistic solutions do not exist. Charlatans and those without a depth of knowledge of the subject offer simplistic solutions to inflation.

Do not believe them.

Instead, hedge against inflation with investments in assets that protect against the decreased purchasing power of your currency. Farmland, real estate, Gold and Bitcoin are assets commonly discussed.

Each of these assets can be effective for a while; however, the complexity of the world economic system results in periods of differing performance.

Each asset is valued against the dollar, and one must consider each performance on a relative basis. How does one perform against the other?

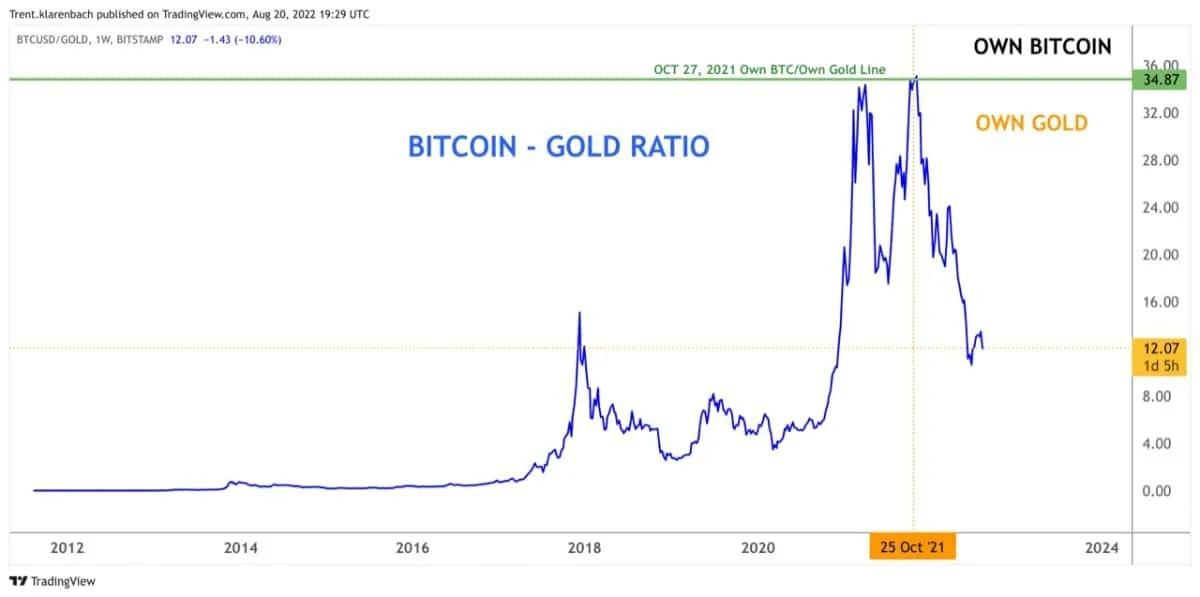

Today's chart displays the Bitcoin-Gold Ratio measuring the performance of each against the other as they have consistent quality, transparent price and characteristics of money that real estate does not possess.

As one can see, Bitcoin has historically outperformed Gold on a relative basis; however, that performance depends on the investment timing.

On October 27, 2021, a buddy asked me if he should invest in Bitcoin or Gold. I highlighted that date on the chart with the yellow dashed line.

My analysis told me that below the ratio of 34.87, Gold was likely to outperform Bitcoin on a relative basis. So far, it has.

I anticipate that Bitcoin will again be an attractive investment relative to Gold and lower my Own Bitcoin/Own Gold line.

I don't know IF, and don’t know WHEN.

Assets should be evaluated on a relative basis when investing.

How are you hedging against inflation?