The Klarenbach Report, July 5

A few weeks ago, I wrote about the four stages of the market structure.

I wrote:

The most effective method is to follow the trend by identifying and understanding the four stages of market structure.

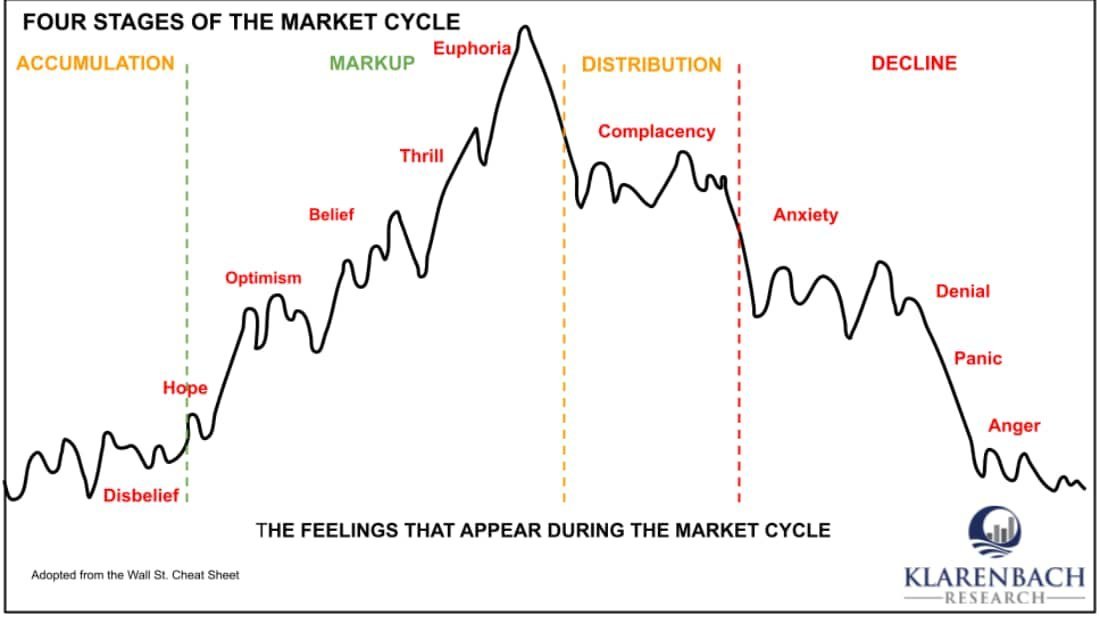

You see, the market structure has four stages:

Stage 1: Accumulation

Stage 2: Markup

Stage 3: Distribution

Stage 4: Decline

You can find this market structure in all asset classes and timeframes.

How can I determine the market cycle stage?

I get that question a lot.

To answer that question, we must know our timeframe.

You see, the market cycle occurs in all timeframes.

The longer timeframe consists of many shorter-term market cycles.

Multiple market cycles arise within each of the four stages.

Moving averages are effective at determining the trend and the market cycle stage.

When they are advancing, then we are in the Markup Stage.

The indecision of the Accumulation and Distribution Stages is shown by the moving averages crossing over one another.

Declining and aligned moving averages mark the Decline Stage.

Perhaps, the most effective method is an assessment of your feelings.

In a rising market, Long position holders may initially feel Disbelief that the price is rising.

That feeling will shift to Hope and then Optimism.

Following new highs after a pullback, we begin to believe that this rally will last. The market advance continues, and Thrill sets in with the prospects of getting rich.

The market continues higher, and we feel Euphoria, during which we marvel at our business acumen and the wealth generated.

The price begins to correct.

We have become Complacent with the recent highs. We consider this a “healthy” correction required to move the market higher. It will come back. We decide not to sell until the price returns to the high.

The price moves lower after leaving the Distribution Stage. We begin to experience Anxiety. I missed the highs and gave back my gains. What should I do?

As the Decline Stage progresses, we begin to feel Denial. The market is stupid. Don’t they know that production is down? We look for reasons to support our beliefs.

The price moves lower. We begin to Panic. Maybe I should sell. Let’s give it one more week.

The price drops some more.

We become Angry. Angry at ourselves. Angry at others. We search for reasons to validate our inaction.

We reach our Max Pain Threshold.

We capitulate.

We sell.

This is when the market bottoms.

The market moves into the Accumulation Stage

The price rises. We feel Disbelief.

The market cycle repeats.

Do you have any Long positions?

Can you identify the Market Cycle Stage?

How are you feeling?

Trent Klarenbach, BSA AgEc, publishes the Klarenbach Grain Report and the Klarenbach Special Crops Report, which can be read at https://www.klarenbach.ca/